The business model currently in place in the chemical distribution sector is coming under pressure. Industrial customers expect clear positioning of their suppliers in selected customer industries and demand a corresponding focusing of the portfolio and core competencies. Investors are also promoting the restructuring of business models and rewarding a more homogeneous orientation. Recent major mergers—such as that between Dow and DuPont—,with their spinoffs into homogeneous individual businesses, are aimed at establishing corresponding global industry leaders. And more chemical players are set to follow.

In addition, digitalization of the business model in the chemical industry is driving changing requirements for integrated, interdisciplinary product and service portfolios. The role of the chemical industry in the ecosystem is shifting, the entry barriers to chemical value chains are falling.

To become an industry leader in the chemical industry, you increasingly need to be able to holistically optimize supply chains, to collaborate intensively in networks with partners who frequently operate in other stages of the value chain, and to create new business models for sustainability along the value chain.

As a result, the challenges facing chemical distributors have also increased. Their role at the interface between chemical production and the customer is currently being questioned.

Once a profitable intermediary position

Chemical distribution gained in importance as chemical companies continued to focus on core competencies and more strategically relevant segments. Chemical companies switched to outsourcing distribution in subcritical markets or for strategically less relevant customers and products to third parties.

On the purchasing side, many concerns benefited from bundling and outsourcing the procurement of chemical ancillary raw materials to distributors by reducing their own complexity, increasing their efficiency and professionalization and thus further refining their focus on strategic categories.

In contrast to chemical enterprises, by bundling ancillary product lines across companies, distributors were able to offer purchasing and sales, including simple chemical value-added, more efficiently than individual chemical companies were capable of doing.

The agility of the distributors is still an important differentiating factor. Chemical companies benefit from distributors’ access to markets and products for which their own offerings do not have the necessary size or degree of development.

Furthermore, chemical firms also reduce credit risks and the level of cash management for smaller customers by working with distributors.

For their part, chemical customers have access to product volumes and order quantities that they would not receive from the chemical manufacturer due to their low strategic relevance (or if so, then only at higher prices). Moreover, the grouping of individual requirements of different chemical products reduces supply chain complexity and purchasing costs.

In addition, chemical distributors often facilitate improved delivery times and higher delivery reliability for ancillary product lines, as well as tailor-made offers or services ranging from quality control to technical product development.

At first glance, the business environment in the chemical distribution segment appears to be consolidated to only a minimal extent compared to chemical manufacturers. 32 distributors cover 80 percent of the market volume traded through distributors in Europe.

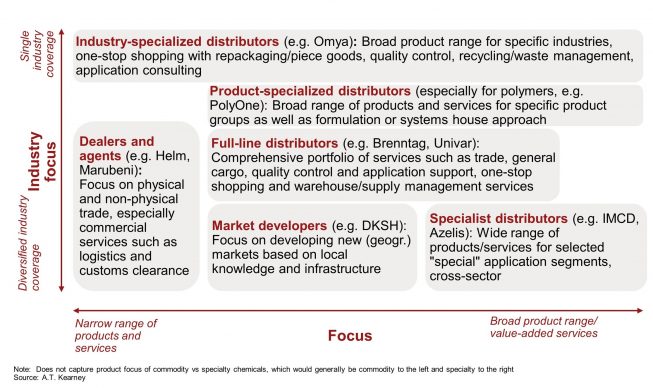

A distinction can be made between different types of chemical distributor:

Trends: Threat to traditional distribution model

Shifts in the customer industries, the realignment of the business portfolios of chemical companies, increasing digitalization and regional shifts in value-added are challenging the traditional distributor model.

In particular, digitalization and the ability to evaluate large amounts of data in real time increase transparency along the supply chain and make it possible to better manage complexity. New market participants, such as Alibaba or Amazon, are entering the field, increasing transparency and facilitating better access to growth markets.

Chemical producers have also found new ways of taking over the distribution task themselves. E-commerce platforms are bringing customers and manufacturers closer together and calling the value-added offered by distributors into question.

Digital tools such as robotic process automation or artificial intelligence make it possible to reduce complexity and automate processes.

In light of these changes, chemical distributors—like chemical companies—need to push ahead with sharpening and realigning their own business models. The full-line distributor model in particular, with its comprehensive portfolio, appears to be too undifferentiated and is coming under increasing pressure.

Consequently, distributors are pushing ahead with vertical integration—or specializing in industry segments such as specialty chemicals or pharmaceuticals, but not without risk. The interfaces between distributors, chemical manufacturers and customers are becoming blurred and distributors are increasingly competing with chemical manufacturers.

The development of specific core competencies in sales markets is also increasing the pressure on chemical producers to cast a critical analytical eye over the commercial basis and the degree of outsourcing to distributors.

New paths

Despite the risks at the interface with chemical producers, success strategies are opening up for distributors:

1. Functional and regional specialization:

One obvious option is to specialize in segments such as basic chemicals or specialty chemicals, or in regions such as China or Europe. The differing requirements in global growth markets require the development of local competencies covering market access, regulations, logistics and infrastructure or even local production structures, which many, especially small and medium-sized chemical producers cannot provide.

2. Transformation into a solution provider:

The business model of distributors is typically not uniquely focused on chemical products; many distributors have built up comprehensive industry expertise outside of chemical production.

The expansion of this competence and the ability to manage ecosystems from a wide variety of suppliers to create integral solutions for selected industries—e.g. industrial cleaning instead of the distribution of cleaning chemicals, wastewater treatment instead of the sale of chemicals, a plastics portfolio including application consulting—could be the keys to distributors differentiating themselves from chemical manufacturers.

3. Partnerships with digital retailers:

New market players are forcing their way into the chemical market; digital platforms offer an opportunity here. They enable broad and efficient market access even for small and medium-sized customers in underdeveloped markets. At the same time, chemical distributors are trying to digitalize their business model and achieve efficiency gains. Their competitive advantage over digital retailers is dwindling in terms of market and customer access and knowledge lead in underdeveloped markets, but unlike digital retailers, they have specific expertise in chemical distribution and product refinement. A partnership would offer significant strategic advantages.

In view of the current disruptions in the chemical industry, distributors have to ask themselves whether “business as usual” is the right strategy to secure their future viability. There have been too many changes recently for them to stand idly by. A strategic adjustment of the distributor business model will determine which distributors will be the future market leaders.

Authors:

Dr. Tobias Lewe, Partner, A.T. Kearney

Dr. Törres Viland, Principal, A.T. Kearney

Peter Schiff, Associate, A.T. Kearney